Instantly Know Your Customer's Credit Profile

Before the Sales Appointment

Drive revenue with instant credit data, customizable lender LEAD scorecards, and real-time analytics on credit trends

Instantly Know Your Customer's Credit Profile

Before the Sales Appointment

Drive revenue with instant credit data, customizable lender LEAD scorecards, and real-time analytics on credit trends

Built For Contractors Who Offer Financing

windows

roofing

siding

Bathrooms

kitchens

additions

hvac

plumbing

electric

flooring

Fencing

hardscapes

solar

security

& more

Built For Contractors Who Offer Financing

home Improvement

Home Services

Solar & More

Getting financing right for your contracting business is daunting.

You Need to...

Submit financial documents and tax returns and undergo background and credit checks just to enroll with lenders.

Pick which finance plans to offer

Incorporate lender fees into your pricing

Train sales teams how to present financing options effectively

Only to...

Cross your fingers that your customer gets approved

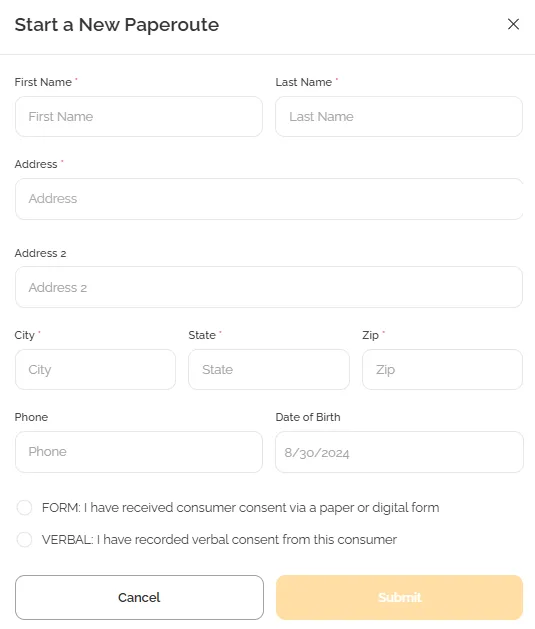

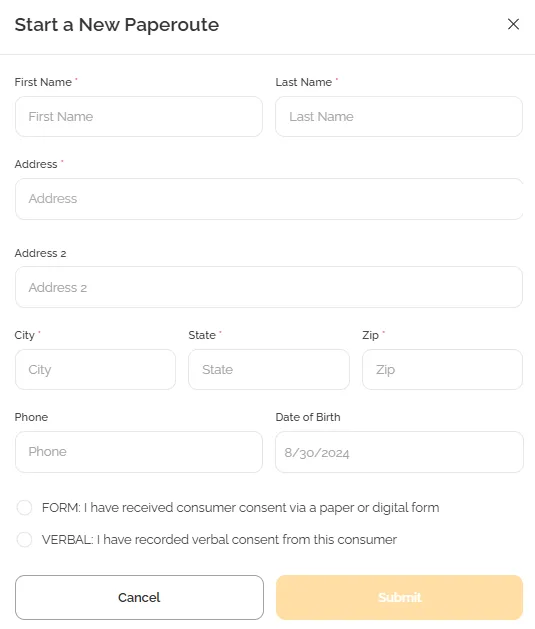

It starts with a

Soft Credit Pull

Soft credit pulls do not place a hard inquiry on your customer's credit report and have no impact on credit score or your lender relationships.

Name and Address are all you need!

Paperoute is most frequently

used during

lead generation or

appointment confirmation

where it is unreasonable to ask a prospective customer for their social security number, income or date of birth.

Take The Guesswork Out of Financing

Most contractors want to focus on home improvement and struggle with offering the right financing to win jobs. All that changes when you start using Paperoute™...

1

Sign Up for Paperoute™

Get instant access to our credit profile platform, custom scoring tools, and real-time analytics.

2

Use the Instant Insights

Apply consumer credit data, tailored lender scores, and detailed analytics to drive revenue, marketing and lender efficiencies.

3

Improve Your Clients' Homes

Get back to the business you love, helping your clients upgrade their homes.

It starts with a

Soft Credit Pull

Soft credit pulls do not place a hard inquiry on your customer's credit report and have no impact on credit score or your lender relationships.

Name and Address are all you need!

Paperoute™ is most frequently used during:

lead generation, or appointment confirmation

where it is unreasonable to ask a prospective customer for their social security number, income, or date of birth.

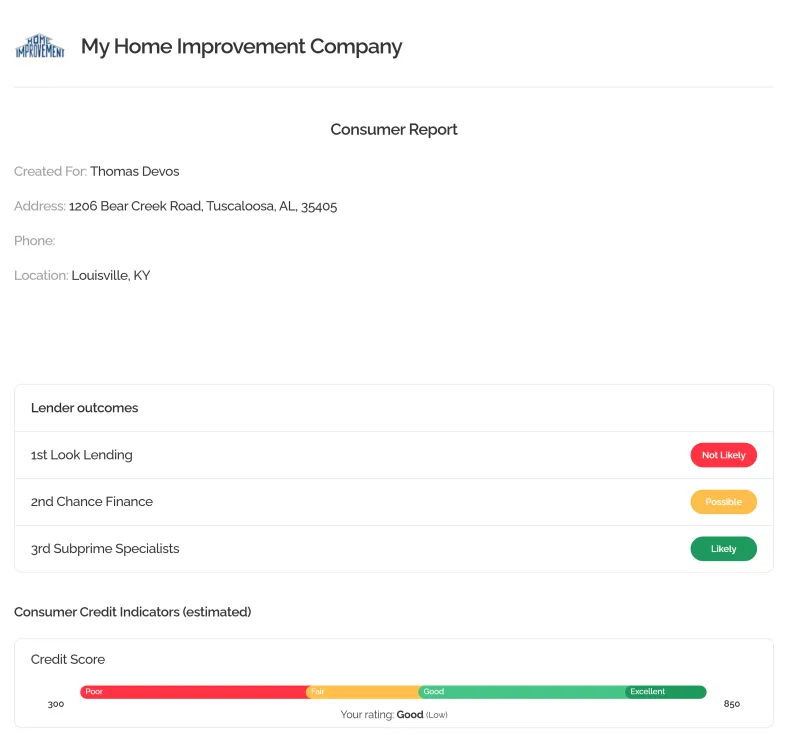

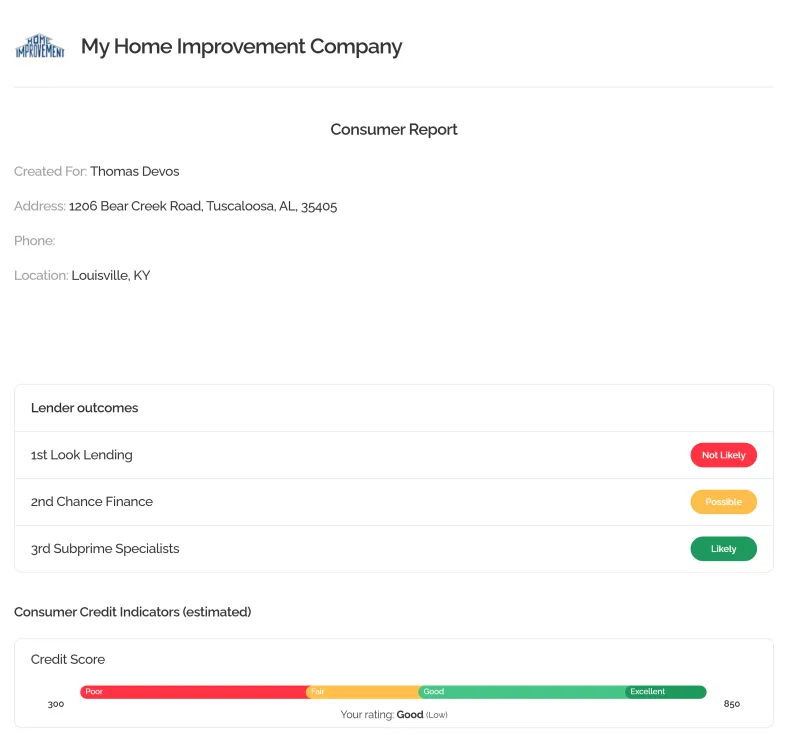

Instantly View

Credit and LEAD Scores

Build a custom LEAD scorecard

for each of your lenders.

Lender Expected Approval or Denial Score.

Members see 10-12 credit attributes inside Paperoute™, including credit score, that make up a consumer credit profile.

Pro tip: Pro members can determine availability of home equity with our popular bonus attribute, balance on open mortgages.

Instantly View

Credit and LEAD Scores

Build a custom LEAD scorecard for each of your lenders.

Lender Expected Approval or Denial Score.

Members see 10-12 credit attributes inside Paperoute™, including credit score, that make up a consumer credit profile.

Download a consumer report which includes lender outcomes and any sharable credit attributes chosen by a company admin.

Pro tip: Pro members can determine availability of home equity with our popular bonus attribute, balance on open mortgages.

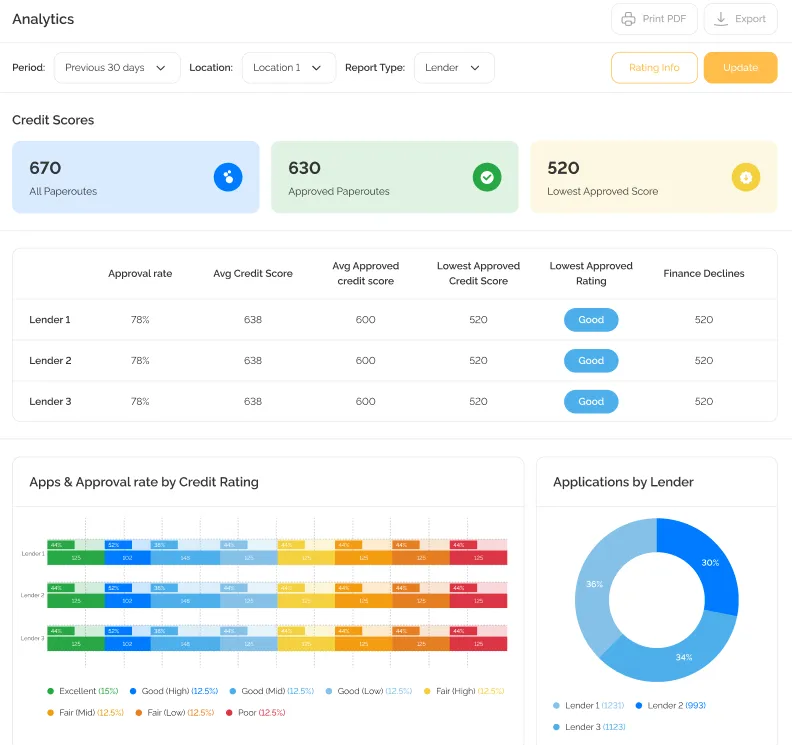

Feedback powers

Credit Transparency

Paperoute™ is powered by member's feedback to deliver real-time and accurate reporting.

Compare lender performance

Track credit trends by location

Analyze credit by marketing source

Optimize lender efficiency

Negotiate lower fees

Take The Guesswork Out of Financing

Most contractors want to focus on home improvement and struggle with offering the right financing to win jobs.

All that changes when you start using Paperoute™...

1

Sign Up for Paperoute™

Get instant access to our credit profile platform, custom scoring tools, and real-time analytics.

2

Use the Instant Insights

Apply consumer credit data, tailored lender scores, and detailed analytics to drive revenue, marketing and lender efficiencies.

3

Improve Your

Customer's Homes

Get back to the business you love, helping your clients upgrade their homes.

Explore Our

Interactive Demo

See how Paperoute™ delivers meaningful credit details in many different ways.

what others are saying

"Taking control of our financing program"

"Our finance turndowns soared from 12% to 35% starting in 2023. I couldn't get real answers or data from my lenders. Paperoute is the only tool that gives me data without bias." - Owner, Memphis TN

"Improved lead scoring"

"I can now add accurate credit details into my lead scoring. This insight has been a game changer for how we prioritize our efforts." - Marketing/Call Center VP, Dallas TX

"Data driven rep assignment"

"I can see how my reps perform based on credit profile. Helping me with lead assignment and identifying training needed" - Sales Manager, Louisville KY

"Having the right conversation, the first time"

"My sales reps are now hearing "Yes" on the first application they send." - Sales Manager, Tampa FL

"Ridiculous ROI"

"Paperoute reporting revealed gaps with our lenders and cost-efficient ways to offer financing. Adding thousands back to our bottom line." - COO, Baltimore MD

"The CRM tool for finance managers"

"I missed out on $2.4M last year from lender turndowns and ridiculous counteroffers. I will not let that happen again." - Owner, Los Angeles CA

Our partners

PRICING

Plans to Fit Your Team

Basic member

$49/month

Tokens from $4.99/ea.

1 Token incl. per month

One User and Location

Use Your Forms and Scripts

No contracts - cancel anytime

Ideal for companies who are looking for credit attributes only.

Standard member

$99/month

Tokens from $4.99/ea.

1 Token incl. per month

Unlimited Users and Locations

Use Your Forms and Scripts

6 Predictive Lender LEAD Scores

No contracts - cancel anytime

Ideal for companies who work with multiple lenders and would like to customize LEAD scores.

pro member

$149/month

Tokens from $4.99/ea.

3 Tokens incl. per month

Unlimited Users and Locations

Use Your Forms and Scripts

6 Predictive Lender LEAD Scores

Marketing and Lender Analytics

No contracts - cancel anytime

Ideal for companies who work with multiple lenders, would like to customize LEAD scores, and see detailed reporting on credit trends.

Most Popular

30 DAYS MONEY BACK GUARANTEE!

We believe in the quality of our platform and are committed to your satisfaction. That’s why we offer a 30-Day Money Back Guarantee on the first month's subscription. If you are not completely satisfied with your purchase, simply return it within 30 days for a full refund, no questions asked.

Risk-Free

Frequently Asked Questions

What is a token?

A token is charged every time you run a soft credit pull and credit attributes are returned. You will not be charged if a customer's credit attributes are not found.

Do my tokens roll over and what happens if I cancel?

Yes. Any unused token will continue to roll over every month until used. You can cancel your subscription at any time. Any unused tokens will be forfeit.

Why do I need consumer consent?

Consumer consent is required under the Fair Credit Reporting Act (FCRA) section 604 to initiate a soft credit pull and receive the consumer's credit attributes. Paperoute™ provides illustrations of several ways to easily adopt consent with your existing workflows.

Which lenders work with Paperoute™?

Paperoute™ is unbiased on which lenders you use. You can create LEAD score models for ANY of the lenders you choose to work with.

Are different user roles available?

Yes. Admins have full privileges while Managers are limited. Managers can run soft pulls and see results, but cannot purchase tokens, change subscriptions, create LEAD scores, and other tasks.

Why is lender feedback so important?

Feedback powers Paperoute's incredible reporting features.

Have more questions? We're here to help

3 Benefits of Knowing a Customer’s Creditworthiness Before the Sale for a Sales Rep

Knowing a customer's creditworthiness before the sales appointment creates a better experience for the customer and the sales representative. ...more

Paperoute ,credit insights

September 29, 2024•2 min read

How to Maximize Your Lead Conversion with Credit Insights

Why credit insights can be the most valuable data for a contractor who relies on financing to secure business and how paperoute helps ...more

Paperoute

September 25, 2024•5 min read

Understanding Soft Credit Checks: What They Are and Why They Matter

Soft credit checks are explained to contractors in the home improvement and home service industries by Paperoute. ...more

Paperoute ,Soft Credit Pulls

September 24, 2024•3 min read

Introducing Paperoute - Creating credit transparency and lender guidance for contractors

Introducing Paperoute, the SaaS platform that brings consumer credit transparency and lender guidance for home improvement and home service businesses. Gain credit insights, streamline sales, and opti... ...more

Paperoute

September 22, 2024•4 min read

Limited Time Offer

Don't Miss Out!

A limited number of $50 OFF Pro Member plans are still available.

Use code: "credit50" for special pricing.

Only $99/month

for a Pro Membership

retail $149/month

A $600 annual savings

Have more questions? We're here to help

© Copyright 2024. MAKE Enterprises LLC, DBA Paperoute™. All rights reserved.

312 S. 4th Street 7th Floor

Louisville, KY 40202